News

New Grants, Free Consulting for Small Businesses Battling to Survive the Pandemic

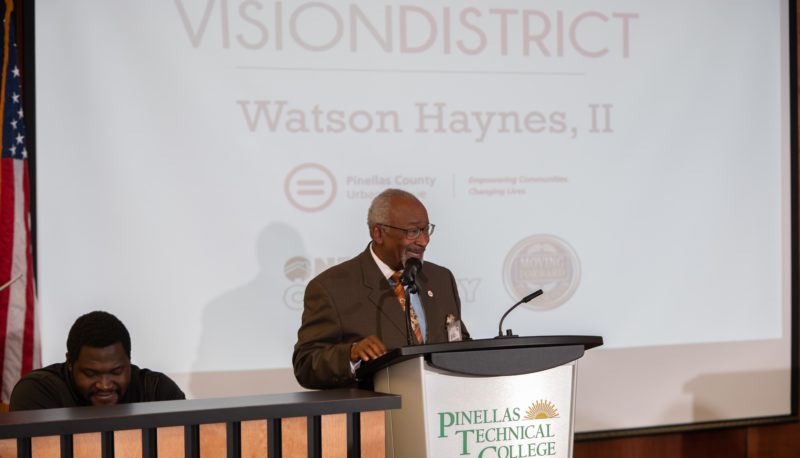

Watson Haynes, CEO of Pinellas County Urban League, is helping to lead a push by partner organizations to raise resources and meet needs for businesses struggling to survive

– Gypsy C. Gallardo for the One Community Business Network

Leaders of the One Community Business Network are working overtime to help raise and connect vital resources to support community businesses that are buckling from Coronavirus shutdowns. Here’s a round-up of the latest actions and resources available, including two new grant sources that are just coming online, as well as a new free consulting service at the Serious Business Academy by Pinellas County Urban League.

*This list will be updated and republished as new resources are identified.

Local COVID-19 Loan Pool & Support Program

Several organizations have joined together in proposing a COVID-19 Loan Pool & Support Program to help community businesses who are not eligible for the federal and state resources announced to date.

This effort is led by Tampa Bay Black Business Investment Corporation, One Community, and Pinellas County Urban League, whose leaders have submitted their proposal to eight local funders to solicit resources.

One Community groups issued a survey to community businesses late last week. According to preliminary results released this Tuesday, 97% of respondents say they’ve already lost revenue as a result of the crisis. Several report that they are on the verge of going under.

Click here to see survey results as of yesterday (for 40 of the 45 responses received).

The quest to raise dollars continues and updates will be provided to the One Community Business Network. To sign-up for updates, email us at OneCommunityPlan@gmail.com.

New Fighting Chance Fund by City of St. Petersburg

At 4 pm today, St. Petersburg Deputy Mayor and City Administrator Dr. Kanika Tomalin announced that the City is creating an unprecedented grant fund to support local businesses. She advises that business owners connect to the City’s social media channels for a rolling release of details on the initiative.

Facebook Small Business Grants

Though not yet open for applications, Facebook announced this week that it would fund grants and provide advertising credits to small businesses to help them survive the Covid-19 pandemic.

A dedicated webpage says this: “We know that your business may be experiencing disruptions resulting from the global outbreak of COVID-19. We’ve heard that a little financial support can go a long way, so we are offering $100M in cash grants and ad credits to help during this challenging time.” The company plans to help up to 30,000 eligible small businesses in over 30 countries where Facebook operates.

Facebook says it will begin taking applications in the coming weeks. In the meantime, go to the Facebook Boost Grants webpage to sign up to receive more information when it becomes available (the sign-up tab is toward the bottom of the page).

LiftFund COVID-19 Relief Program

The LiftFund will provide grants to small businesses in Alabama, Arkansas (Crittenden County), Florida, Georgia, Kentucky, Missouri (Desoto County), Tennessee and Texas. Small businesses in these states should apply for a grant by visiting www.liftfund.com.

The organization’s website says “We know that community keeps us going during these trying times. Things are changing daily, and for the unforeseeable future. We know this has affected your business in many ways so we are offering services and loans to support you during these challenging times. If you are in need of immediate consultation and would like support in planning and forecasting please contact us on our website.”

The LiftFund also offers a number for businesses seeking help (888.215.2373) and a host of other potentially useful resources online.

SBA Economic Injury Disaster Loan (EIDL)

Small businesses AND non-profits can qualify for up to $2 million in loan dollars through this U.S. Small Business Administration program. Unlike the Florida Emergency Bridge Loan Program, this source does not have a minimum or maximum number of employees needed to apply (**businesses with only 1 employee are eligible). Interest rates are 3.75% for for-profit businesses and 2.75% for non-profit organizations.

Applicants do not go through a bank to apply. Business owners apply directly to SBA’s Disaster Assistance Program. For additional information, visit the SBA webpage.

NEW Pinellas County Urban League Serious Business Academy (SBA)

With new resources from the Florida Department of Economic Opportunity, the Urban League is providing hands-on help and free expert consulting through the Serious Business Academy (SBA). This resource is ideal for community business that need help with their taxes and the set-up of financial management systems. Services include the following:

- Small Business Assessments

- 1-on-1 Coaching

- Business Success Planning

- Business Credit

- Small Business Workshops

- Financial Statement Assistance

- Service Benefits

- Marketing Planning

- CPA Assistance

- Business Taxes

- Loan Facilitation

- Line of Credit

To schedule a Zoom meeting or conference call, reach Lisa Kirkland at 727-327-2081 Ext 132 or lkirkland@pcul.org.

Florida Small Business Emergency Bridge Loan Program

A Florida SBDC director said yesterday that the Tampa Bay region had received 240 applications to the Florida Small Business Emergency Bridge Loan Program as of the morning of March 24th.

This resource is available to small business owners statewide that experienced economic damage as a result of COVID-19. The program website says “These short-term, interest-free working capital loans are intended to “bridge the gap” between the time a major catastrophe hits and when a business has secured longer term recovery resources, such as sufficient profits from a revived business, receipt of payments on insurance claims or federal disaster assistance.” Program guidelines specify that loans made under the program “are short-term debt loans made by the state of Florida using public funds – they are not grants.”

Please note, this loan is interest free for one year. After that, borrowers face 12% interest on the unpaid balance as well as late fees and collection fees.

Applications will be accepted under this program through May, 8, 2020, contingent on availability of funds. For additional information, or to apply online, visit the state’s Business Recovery page.

To get help locally in completing the application, contact your local Florida Small Business Development Center (SBDC) office. To locate your local Florida SBDC visit www.FloridaSBDC.org/locations or contact us toll-free (833) 832-4494. If in Pinellas County, contact the SBDC at Pinellas County Economic Development at 727-453-7200 or cmurray@pinellascounty.org.

Tampa Bay Black Business Investment Corporation (BBIC)

The BBIC provides year-round training, counseling and loans to small businesses across six-counties. Recognizing the need for added support during the COVID-19 crisis, BBIC is offering telephone consulting sessions to area businesses to help them navigate resources or apply for loan dollars through the organization (of $500 to $25,000). For help with assessing your capital needs and exploring capital alternatives, reach Brent Everett, Sr. Business Development Officer & Portfolio Manager, at 813-981-8000 or via email at beverett@tampabaybbic.com.

To tell our readers about a service or resource you offer, write to Gypsy Gallardo, Executive Director of The One Community Plan, at gypsy@powerbrokermagazine.com.